Table of contents:

- Exemptions from the obligation to use KSeF

- KSeF obligation schedule

- Access to the KSeF system – methods of authenticating entities using the KSeF

- What is a KSeF certificate?

- What is an authorization token?

- Who must submit ZAW-FA and who does not?

- KSeF and foreign clients

- Benefits of introducing the KSeF system

The National e-Invoicing System (KSeF) will become mandatory for Polish entrepreneurs in 2026. KSeF is a nationwide ICT platform administered by the Ministry of Finance, used for issuing, receiving, and storing structured invoices. These invoices take the form of an XML file compliant with a unified template, which allows for the automation of accounting processes.

Exemptions from the obligation to use KSeF

The obligation to use KSeF will ultimately cover a wide group of taxpayers; however, regulations (including the Rozporządzenia wykonawcze do Krajowego Systemu e-Faktur, Ustawa o podatku od towarów i usług) provide for significant exemptions – both permanent and temporary.

🔹Permanent Exemptions

There are groups of taxpayers and types of transactions that are permanently excluded from the obligation to use the system:

- Foreign entities: The obligation does not apply to companies that do not have a registered office or a fixed place of business in Poland. If they have a fixed place of business that does not participate in each delivery of goods or services, they are also exempt. These entities may, however, use KSeF voluntarily. It should be noted that KSeF is not used for reporting purchases from foreign suppliers, but only for issuing invoices according to Polish regulations.

- B2C invoices: Sales documented for natural persons not conducting business activity do not have to be reported in KSeF. Issuing invoices in the system for consumers remains voluntary.

- Specific tansport and financial services: Exemptions from KSeF apply to documents recognized as invoices in certain cases, such as:

- toll highway journeys documented by a receipt with a Tax Identification Number (NIP),

- passenger transport services documented by tickets (e.g., rail, bus),

- air traffic control and supervision services,

- financial and insurance services exempt from VAT, if documented by simplified invoices with a limited scope of data.

- Proforma invoices: According to the VAT Act (Ustawa o Vat), these documents are not invoices, therefore, their issuance takes place entirely outside of KSeF system.

🔹Temporary exemptions (transitional period until the end of 2026)

To facilitate adaptation for companies, the legislator introduced thresholds and exceptions valid until December 31, 2026:

- Small taxpayers (limit of 10,000 PLN): Entrepreneurs may issue invoices outside of KSeF (on paper or electronically) if the total value of sales with tax on invoices does not exceed 10,000 PLN in each month. If the limit is exceeded, KSeF must be used for that specific invoice and every subsequent one in that month.

- Cash registers and receipts with NIP: Until the end of 2026, invoices can be issued using fiscal cash registers (including receipts with NIP up to 450 PLN recognized as simplified invoices) without the need to send them to KSeF.

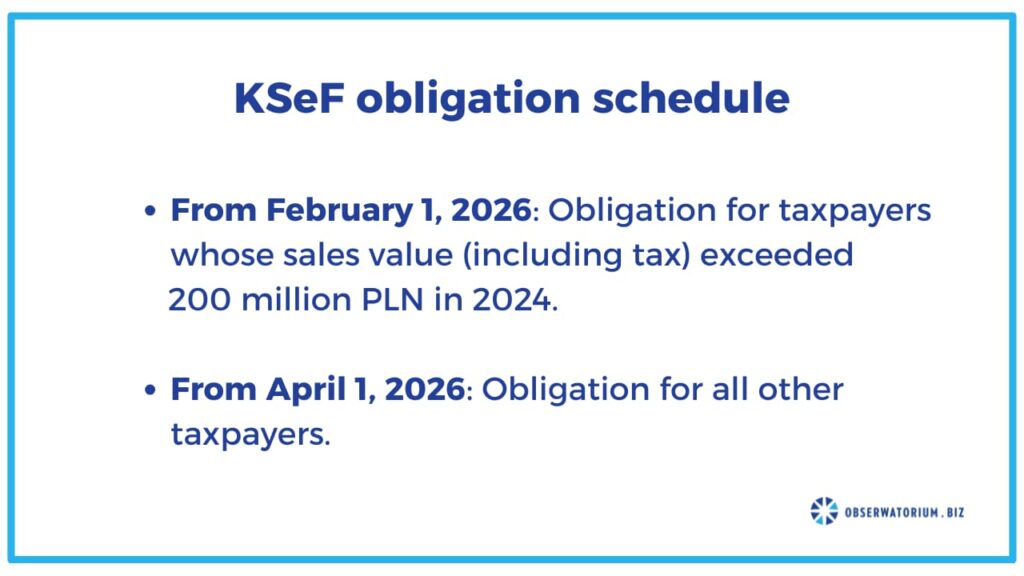

KSeF obligation schedule

The implementation of the KSeF obligation will take place in stages:

- From February 1, 2026: Obligation for taxpayers whose sales value (including tax) exceeded 200 million PLN in 2024.

- From April 1, 2026: Obligation for all other taxpayers.

Access to the KSeF system – methods of authenticating entities using the KSeF

The KSeF system provides several authentication methods, which can be divided into two main categories:

– methods for users logging directly into the KSeF system,

– methods used for integration with external software (e.g., accounting software).

According to § 6. 1. of the ROZPORZĄDZENIA MINISTRA FINANSÓW I GOSPODARKI z dnia 12 grudnia 2025 r., on the use of the National e-Invoicing System, one can use:

- an electronic identification means issued in an electronic identification system connected to the national electronic identification node (e.g., the mObywatel application),

- data verified by a qualified electronic signature,

- data verified by a qualified electronic seal,

- a KSeF certificate generated after authenticating in one of the above ways.

Additionally, pursuant to § 13. 1 of the aforementioned Regulation, entities using the National e-Invoice System may also use a trusted signature for authentication in the case of natural persons (until 31 March 2026) and an authorisation token in the case of legal entities (until 31 December 2026).

What is a KSeF certificate?

A KSeF certificate is an electronic key issued directly in the KSeF system, used for the unique identification of an entity or person using the system via integrated software. It is essential for the automatic exchange of data between the financial-accounting system and KSeF. From 2027, this will be the only method for using KSeF via external software.

The KSeF certificate also enables issuing invoices in emergency mode or without internet access by marking them with a special code based on the certificate.

To legally issue an invoice offline (e.g., during a system failure or as part of the offline24 mode, which allows sending the invoice to the system on the next business day), a company must first generate and download a special KSeF certificate (type 2). This certificate is necessary to generate a second QR code on the offline invoice, which is accompanied by a signature confirming the issuer’s identity.

The application for a certificate is submitted in the Certificate and Authorization Module (MCU) or directly in the KSeF Taxpayer Application. The maximum validity of the certificate is 2 years. A NIP entity can have up to 100 active certificates, and a natural person with a PESEL – up to 2.

What is an authorization token?

An authorization token is a unique, 40-character alphanumeric string generated in KSeF after authentication. It allows integrated applications to access KSeF without logging in each time via signatures (qualifield or trusted ones). It is convenient for automating processes and granting access to employees or accounting offices without disclosing personal data, but it should be remembered that it will be withdrawn at the end of 2026. Furthermore, if you authenticate yourself in this way, it will not be possible to generate a KSeF certificate.

How does managing permission work in the KSeF system?

Access to KSeF functions is regulated by a system of permissions that can be granted or revoked in two ways:

- via so called ZAW-FA notification

- electronically in the system

The ZAW-FA form is an official notification submitted to the tax office to grant or revoke permissions. It allows for the appointment of the first natural person (the so-called super-administrator) who will manage permissions on behalf of the entity. Only this person, after the tax office processes the application, will be able to log in and grant further permissions electronically.

The ZAW-FA form also allows you to revoke access, e.g. to a former employee or accounting office, as well as to register a fingerprint of a qualified electronic signature that does not contain a tax identification number (NIP) or personal identification number (PESEL) (e.g. in the case of foreigners).

Who must submit ZAW-FA and who does not?

- Must notify:

- Entities that are not natural persons (companies, foundations, associations) that do not possess a qualified electronic seal and want to grant the first permissions.

- In specific cases It is also for entities that must report a qualified signature without NIP/PESEL identifiers.

2.Do not have to notify:

- Natural persons conducting a sole proprietorship (JDG), as they gain ownership rights automatically after the first authentication with a Trusted Profile or qualified signature.

- Entities possessing a qualified electronic seal with NIP do not need to submit it. If the stamp contains a tax identification number (NIP), companies can use KSeF automatically based on so-called ownership rights (assigned by default, systemically for the taxpayer’s NIP identifier), without the need to submit any documents to the office. Such a stamp uniquely identifies a legal entity, so KSeF will automatically grant access.

- Internal assignments: The form is not required for persons whose permissions were granted internally in KSeF by someone with ownership access , for example, if the owner of a sole proprietorship or a member of the company’s management board who already has active access grants permissions to another user directly in the KSeF application.

The form can be submitted in paper form to the relevant tax office or electronically, e.g. via e-Urząd Skarbowy (e-Tax Office) as an attachment to a General Letter.

From January 1, 2026, notifications submitted via ePUAP are not recognized as effectively delivered.

KSeF and foreign clients

Receiving invoices by foreign buyers

Foreign clients without a Polish NIP cannot log into KSeF to download an invoice. Therefore, the seller must deliver the invoice in an agreed manner (e.g., PDF or paper), and such an invoice (visualization of a structured invoice) must feature a QR code for verification in the KSeF system.

The invoice may be prepared in a different language, but its substantive data must be consistent with the XML file sent to KSeF.

Authentication of foreigners and foreign signatures

Foreigners who must log into KSeF (e.g., as board members of Polish companies) can use foreign qualified electronic signatures. If the signature does not contain a NIP or PESEL number.

It is necessary to submit the ZAW-FA form to the Polish tax office to report the certificate’s fingerprint (cryptographic hash). Only after this information has been entered by an official will the foreigner be able to authenticate themselves in KSeF with this signature.

Self-billing

The system allows buyers from other EU countries with a VAT UE number to issue invoices on behalf of a Polish seller under the self-billing procedure. In such cases, the Polish seller must first grant the buyer the appropriate permissions directly in the system.

Buyer identification without NIP

When issuing an invoice for a foreign client (buyer without NIP), the BrakID field in the XML structure is filled with the value “1”. The system allows for issuing an invoice without a buyer identifier, which is key for international transactions.

For foreign customers, KSeF primarily means a change in the form of documents received (invoices with a QR code) and the need to complete formalities (ZAW-FA) if the customer manages a Polish entity and uses a foreign e-signature.

Benefits of introducing the KSeF system

Key benefits include:

- reducing the risk of errors due to a uniform invoice format

- streamlining document flow (invoices reach the recipient almost in real-time),

- the ability to import data directly into accounting systems.

Furthermore, invoices are archived for 10 years, eliminating the risk of loss. There will also be an option to obtain a VAT refund in a shortened period of 40 days (instead of 60).

Publication date: 21.01.2026